As the 2024 tax season approaches, it's essential to understand the new tax brackets and deductions to minimize your tax liability. The IRS has released the updated tax tables, and we've got you covered with a comprehensive guide to help you navigate the changes. In this article, we'll break down the 2024 tax brackets, standard deductions, and other key deductions you need to know.

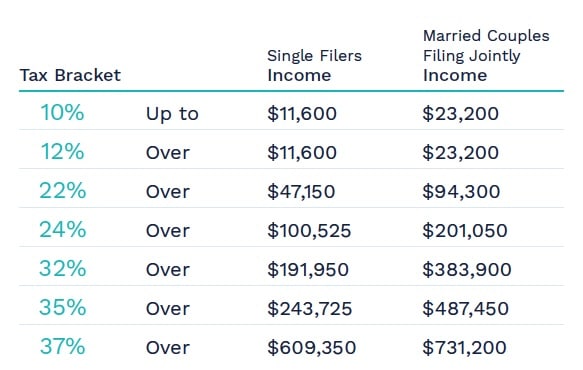

2024 Tax Brackets

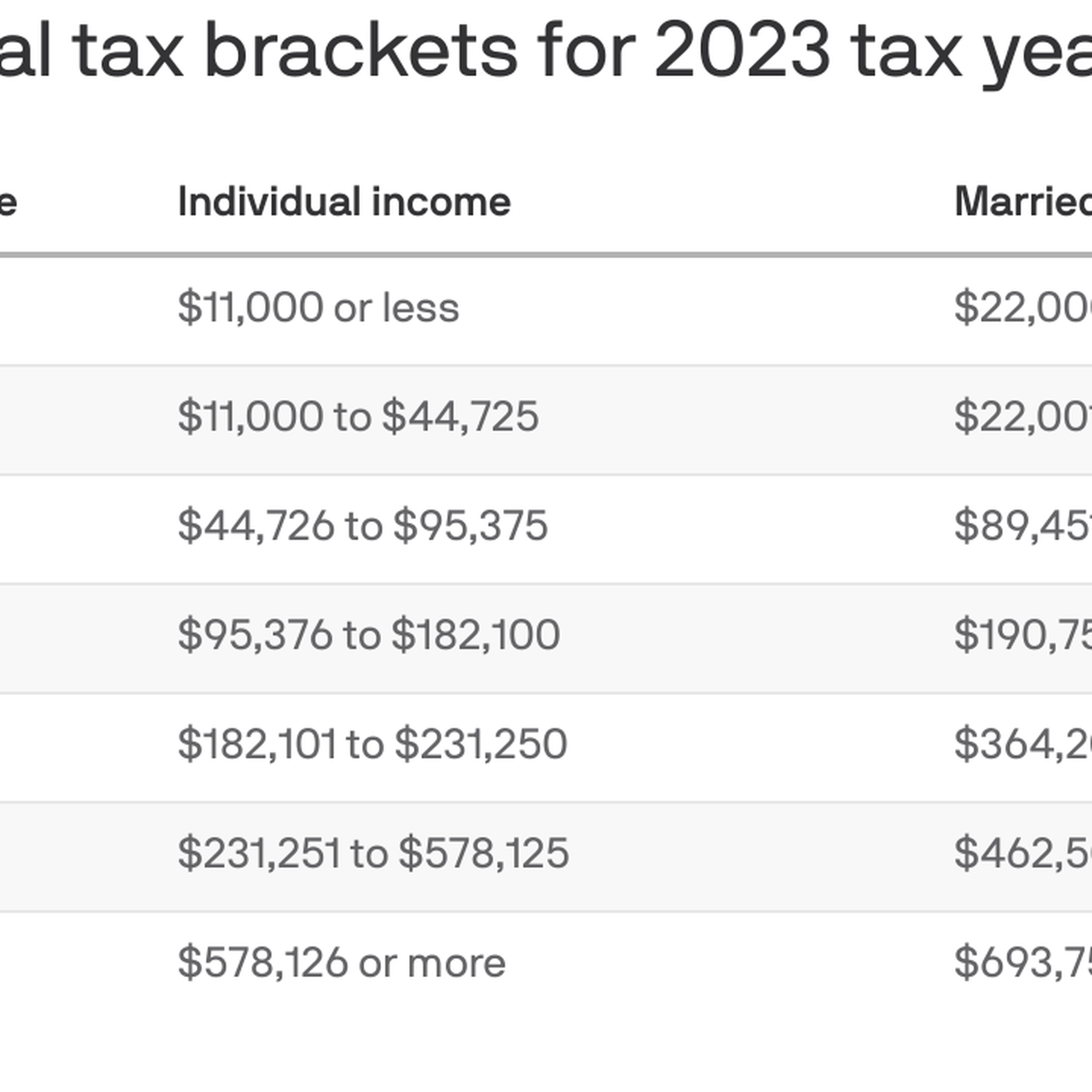

The IRS has adjusted the tax brackets for the 2024 tax year to account for inflation. The new tax brackets are as follows:

Single Filers:

+ 10%: $0 - $11,600

+ 12%: $11,601 - $47,150

+ 22%: $47,151 - $100,525

+ 24%: $100,526 - $191,950

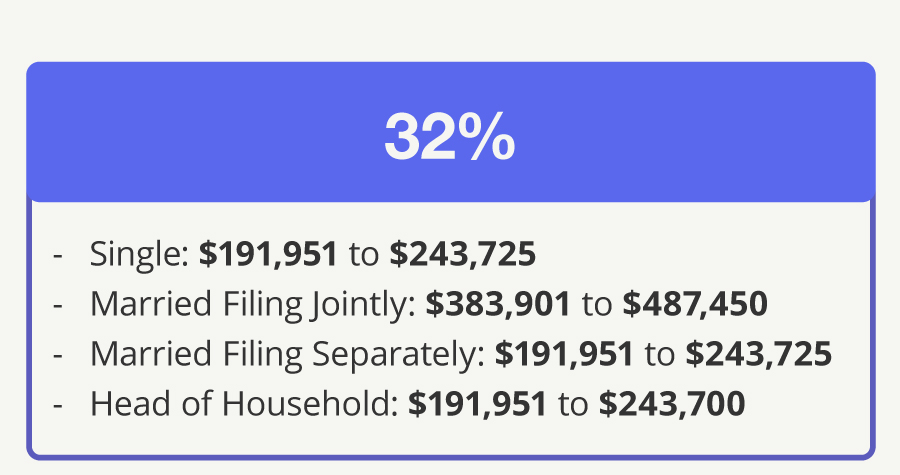

+ 32%: $191,951 - $243,725

+ 35%: $243,726 - $609,350

+ 37%: $609,351 and above

Joint Filers:

+ 10%: $0 - $23,200

+ 12%: $23,201 - $94,300

+ 22%: $94,301 - $201,050

+ 24%: $201,051 - $383,900

+ 32%: $383,901 - $487,450

+ 35%: $487,451 - $731,200

+ 37%: $731,201 and above

Head of Household Filers:

+ 10%: $0 - $15,700

+ 12%: $15,701 - $59,850

+ 22%: $59,851 - $100,525

+ 24%: $100,526 - $191,950

+ 32%: $191,951 - $243,725

+ 35%: $243,726 - $609,350

+ 37%: $609,351 and above

2024 Standard Deductions

The standard deduction for the 2024 tax year has also increased. The new standard deductions are:

Single Filers: $13,850

Joint Filers: $27,700

Head of Household Filers: $20,800

Married Filing Separately: $13,850

Other Key Deductions

In addition to the standard deduction, there are several other deductions you may be eligible for, including:

Mortgage Interest Deduction: You can deduct the interest paid on your primary residence and second home, up to a maximum of $750,000.

Charitable Donations: You can deduct cash and non-cash donations to qualified charitable organizations.

Medical Expenses: You can deduct medical expenses that exceed 10% of your adjusted gross income.

State and Local Taxes (SALT): You can deduct up to $10,000 in state and local taxes.

Understanding the 2024 tax brackets and deductions is crucial to minimizing your tax liability. By taking advantage of the standard deduction, mortgage interest deduction, charitable donations, medical expenses, and SALT deduction, you can reduce your taxable income and lower your tax bill. Remember to consult with a tax professional or financial advisor to ensure you're taking advantage of all the deductions you're eligible for. Visit

IRS.com for more information on the 2024 tax season and to stay up-to-date on any changes to the tax code.

Note: The information in this article is subject to change and may not reflect any future updates to the tax code. It's always best to consult with a tax professional or financial advisor for personalized advice.